There are good reasons why it has been a while since I last wrote about wine and the dollar’s foreign exchange value. A lot of things have shaken up the pattern of wine sales here in the U.S. market, especially the channel-shifting that occurred during the covid pandemic and uneven return to what we laughingly call “normal.”

Many factors shaped the pattern of international wine imports and exports, too, especially supply chain bottlenecks that saw the cost of container shipments zoom up by a factor of ten (when you could find a container) and have now settled back down to roughly pre-pandemic levels.

Falling Dollar, Bouncing Dollar

The exchange rate has been a factor in the wine market through all of this, but it wasn’t really the important factor in most cases. The dust has settled enough now, however, that we need to think about the dollar’s value once again.

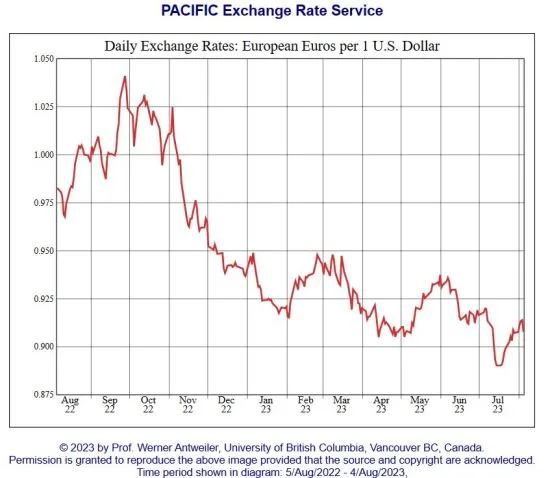

Although the situation can vary from currency to currency, the overall trend for the U.S. dollar in the last year has been down (see the graph above of the USD versus the EUR). The dollar fell sharply through the end of January and has bounced up and down a bit but has been in a downward trend since then.

A cheaper dollar makes imports more expensive since each greenback buys fewer units of foreign exchange. U.S. exports benefit because a cheaper USD means a lower cost to foreign buyers. It takes a while for the impact of an exchange rate

This Article was originally published on The Wine Economist